Competitive intelligence research can help your company get ahead, but to be effective, it has to be done right. Here are 10 tips to help you kick off your competitive intelligence program.

Continue Reading

Competitive intelligence research can help your company get ahead, but to be effective, it has to be done right. Here are 10 tips to help you kick off your competitive intelligence program.

Continue Reading

Best Practices Identified During COVID-19 Mystery Shopping: Canadian Tire: No delay in ordering / picking up merchandise What happened: L.L.Bean: Making it extremely easy to return clothing What happened: Worst Practices Identified During COVID-19 Mystery Shopping: No Frills: Lack of floor staff results in over-stressed cashiers reacting rudely to customers What happened: Staples: Contact centre not taking calls What happened:

Continue Reading

If your company or organization does not have competitive intelligence rules in place or if the rules are filled with lengthy legalese, please consider incorporating these rules that are easy to read and follow: Do not actively seek to obtain, or gain access to, trade secrets belonging to another company or encourage an employee of another company to do the same on behalf of you. Do not seek to obtain, or gain access to, competitive information from a third party if you believe that information may have been wrongfully obtained. Do not misrepresent your identity or employment, or use false pretexts of any kind, to obtain competitor information. Do not… Read More

Continue Reading

Introduction Sometimes marketing departments under pressure to learn about competitive threats, will request that their field staff gather CI without giving any direction. Whether they don’t want to risk turning off team members by imposing too many “rules” or are simply too busy juggling priorities, the outcome will be disappointing. I these situations, CI invariably becomes the flavour of the month versus providing ongoing strategic value. Factors Driving Failure Factors (and consequences) that sabotage what otherwise would be an effective communication process are: Data not is verified, resulting in incomplete, unclear and inaccurate findings. Data dumping occurs, making reading painfully time consuming and boring. Duplication of information creates the impression… Read More

Continue Reading

Introduction Executing a Pharma Competitive Intelligence study is anything but straight forward. It’s a combination of investigation, intuition, blending, synthesizing, quick study, obsessing and number crunching. Let’s spell out the steps and time that goes into a typical pharma Competitive Intelligence study. 1. Finalize Questions (10 Hours) Not only do you need to put together a list of questions that are precise, but the assumptions behind the questions have to be tested as well (If, e.g., one of the questions is, “What do other national diabetes associations besides The Canadian Diabetes Association feel about a national diabetes strategy?”, you’ll have to check out if there are, in fact, other… Read More

Continue Reading

Introduction Are your team members are all over the map when gathering Competitive Intelligence? Do they generate the same or similar information, start from scratch each time they gather Competitive Intelligence or provide unfiltered data that lacks insight? If so, then it’s time to formalize a Competitive Intelligence program. The following steps explain how. Key Steps Start by identifying those negative perceptions (e.g. “Competitive Intelligence” is spying”) that will hinder any effort to set up the program. Create a Competitive Intelligence mission statement (e.g. “provide the right information, to the right people, at the right time, to make the right decision”, “fill information gaps that market research is unable to”,… Read More

Continue Reading

Mistake #1 – Assume Market Research Terminology Example – “Who is on your a customer panel?” Lesson – Competitive Intelligence uses a cross section of buyers, associations, key opinion leaders, former employees, customers, competitors, and any other respondent group who can help. There is no predetermined panel. Mistake #2 – Base Sample Size on a Formula Example – “What will the margin of error be for this sample size?” Lesson – Most respondents are B2B, not consumer. What counts is not the number of interviews completed but the credibility of the respondent (i.e. title, knowledge level, insights). Mistake #3 – Assign Probabilities Example – “What is the probability… Read More

Continue Reading

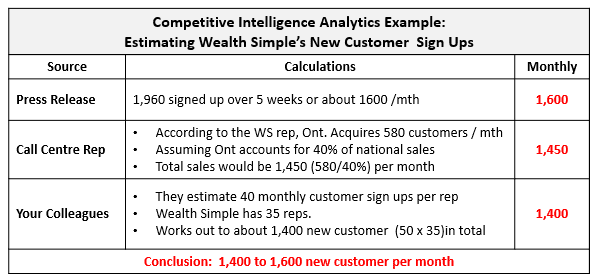

One of the biggest challenges in competitive intelligence is ensuring your findings are verifiable. In competitive intelligence we do not have the option, as with marketing research, where a large sample of respondents ensures you a high level of accuracy. Because you are targeting a small group of highly informed respondents, you would be very lucky to complete 20 to 30 competitive intelligence surveys, versus the hundreds you can in market research. Terms such as “corroboration” and “triangulation” are bantered around in competitive intelligence as ways to ensure the results are accurate and verifiable. But what lacks are actual examples to follow. With this in mind, let me share you… Read More

Continue Reading