Creating a list of key intelligence questions for pharma competitive intelligence studies can be an arduous task. It requires balancing the interests of stakeholders with the sourcing skills of team members and with the level of cooperation of competitor respondents.

Before developing your key questions, be sure that all stakeholders clearly understand the reason behind the need for a pharma competitive intelligence program. When everybody understands the intelligence needs, their input will be more helpful in achieving your goal.

Follow the following 5 key intelligence question tips to help you develop the questions that will help yield solid returns on your competitive intelligence program.

More information on learning about the key steps to setting up a competitive intelligence program

5 Tips for Developing Key Pharma Competitive Intelligence Questions:

1. Make The Competitive Intelligence Questions Specific

Be specific and encourage your responders to be specific as well by crafting your questions in a way that encourages clarity. For example, “What will their launch budget be?” is opened ended. Change this to “Will their marketing spending be significantly higher, lower or about the same compared to previous oncology product launches?” and you will collect more actionable data.

2. Bleed Out The Question

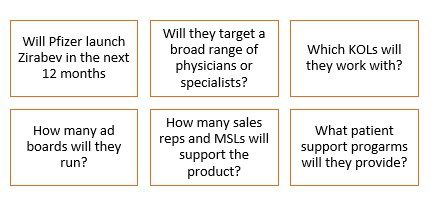

Sometimes, you can get more details by digging deeper into the question. For example, you can break out a question about the number of reps into more specific details about the sales force.

Original question: “How many sales reps will support Zirabev?”

Question with details: “ How many full-time sales reps will support Zirabev?”, “How many part-time reps?”, “Will they have a specialty sales force?”

3. Think Outside The Box

It is easy to get lost in the minutiae of reconstructing a competitor’s launch strategy. Think outside the box. For example, ask questions such as “ Is the competitor pursuing a Canada only or global strategy?”

4. Avoid Industry Jargon or Abbreviations

Industry jargon and abbreviations can be easily misunderstood as they are sometimes used with different meanings from one company to another. Clarity is the key to ensuring that you obtain accurate details.

Original question: “What will Pfizer’s messaging be to physicians?”

Question with clearer wording: “What is Zirabev’s key advantage over other breast cancer drugs?”

5. Limit The Number of Key Intelligence Questions to 15

Asking the right number of questions is critical because too many questions will hinder your competitive intelligence program. Asking a laundry list of questions will tip off the competitor. When this happens they will misinform, close down or even fast track their efforts. So what should you do when your stakeholders provide you with a list of 40 or more questions to answer? Focus on the priority questions and eliminate questions that appear to be duplicated.

The Challenge with Key Intelligence Questions

In competitive intelligence, we often speak about “Key Intelligence Questions” (also known as KIQs). It sounds straight forward, but in reality, putting together the questions is creating the blueprint for what your study will accomplish and how it will be executed. It is easy to say but much harder to do. An experienced competitive intelligence researcher could save you time and ensure a more beneficial study.

If you have questions or would like assistance from experts in this field, contact Market Alert Limited.