INTRODUCTION

Typical Pharma Competitive Intelligence goals are to assess a competitor threat or to obtain reliable information on your competitor’s sales force size, regional allocation, CHE efforts and presentation tools.

Depending upon your methodology, gathering Pharma Competitive Intelligence can place you at risk. For example, too many phone calls to your competitor will alert them. They could then counter by providing misinformation or fast-tracking their own initiatives and marketing efforts to gain the advantage. There is also the issue of potentially over-stepping ethical boundaries.

A workable resolution is to tap primary sources of competitor information without contacting your competitor. And…to do so in an ethical manner.

Where to go from here?

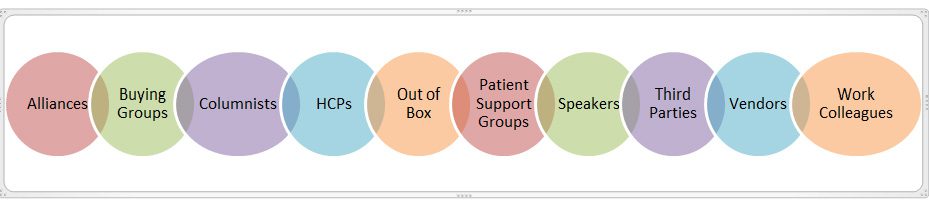

TEN SOURCES to TAP for PHARMA COMPETITIVE INTELLIGENCE

Alliances

These are companies who co-market with your firm or foundations you support. This is an obvious and often willing source and should be number one on your “go to” list.

Buying Groups

Buying groups, wholesalers and purchasing agents can be very helpful to fill specific gaps such as timing of a competitor launch and competitor pricing.

Columnists

These include magazine columnists, trade article contributors and bloggers who demonstrate knowledge about your competitor.

Health Care Professionals

Physicians, nurses and dietitians are your buyers. Have your field representatives approach them. And have your market research interviewers probe for some competitive intelligence when conducting medical interviews.

Out of the Box

These are individuals whom you had not originally thought of to contact. You have used some innovative thinking to develop these sources. For example, approach your stockbroker, to share any research they have done on your competitor.

Patient Support Groups

Patient support groups are an excellent venue for connecting with patients directly, especially in high profile therapeutic areas such as oncology.

Speakers

At a Pharma conference a representative of a direct competitor is scheduled to speak. Why not ask them to share their insights on a topic on which you need some information at the question period at the end of a session?

Third Party Contacts

These are acquaintances who work for another company, are a former employee, or are members of an association you belong to. They are an excellent source for “big picture” insights as well as specific details when able to provide comment.

Vendors

Consider vendors, such as your advertising agency, public relations firm, outside consultants or recruiting agencies as sources of competitive intelligence. While it is in their interest to help you grow your business, be careful as to whom you approach. You never know when they will share information about your company, in say as sales pitch, to one of your competitors.

Work Colleagues

In modern day Pharma companies, there is no shortage of colleagues to contact including government affairs, territory managers, medical science liaison reps, forecasting, marketing research and investor relations. An electronic template will facilitate obtaining the competitive intelligence data without taking up too much of their time or yours.

NEXT STEPS

Once the competitive data has been collected the next step is analyzing and synthesizing your data into meaningful and actionable competitive intelligence to support decision–making.

Thank you for reading this blog. Please connect with us if you have any questions.

Yours,

David Lithwick