Introduction

Unlike market research reporting where often an industry-standard format is used among researchers, there are none in mystery shopping. Providers frequently create their own report format based on what has proven successful in the past coupled with what the shop dynamics call for.

With this in mind, I would like to share with you some tips based on 30 years of financial mystery shopping.

Clarification

Let’s first clarify, through example, the difference between a broad-based and a deep dive financial mystery shop:

Broad-Based would be shopping a 600 Royal Bank branches to assess whether basic customer service standards (e.g. welcoming customers, thanking them for coming to the branch, asking what help they require) are being met.

Deep Dive would be shopping all 27 Connect First Credit Union branches, not only to assess customer experience but also to evaluate each branch’s efforts in following the credit union’s COVID safety protocols and promoting digital banking.

Tips for Mystery Shop Reports

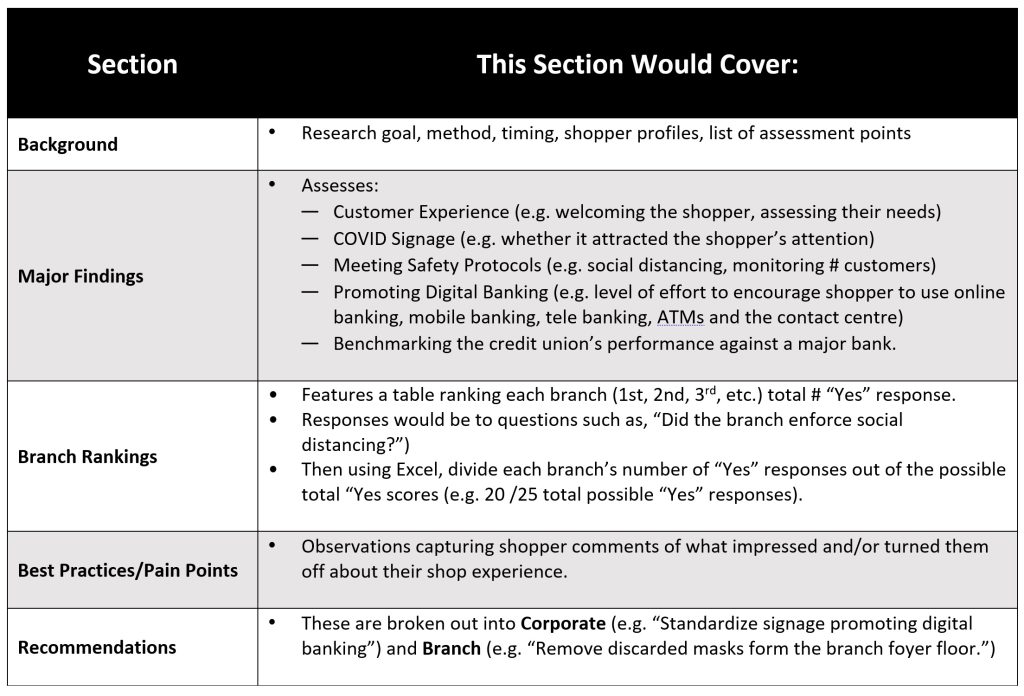

Continuing with the credit union example, an Overall Performance Report and individual branch reports are recommended.

Contents of the Overall Performance Report are described below:

The individual branch reports would each contain:

- Key findings specific to that branch

- A table comparing the branch’s performance to the “average” (or norm) of the other 27 branches

- The shopper’s “likes/dislikes” based on their shop experience

- Recommendations

- The shopper’s survey.

But That’s Not All…..

You should also be prepared to review the individual branch reports with those branch managers who want to gain further insight. These discussions typically last 20 to 45 minutes each.

Contact Market Alert for Mystery Shop Expertise

If you need assistance from a team with extensive experience in conducting mystery shop programs, please contact us. We would be happy to help.