HIGHLIGHTS FROM A THREE-YEAR MYSTERY SHOP

Introduction

Over the past 3 years we mystery shopped 24 credit unions (on our own initiative) to dig deeper into branch and contact centre staff performance.

We looked at appointment scheduling, needs assessment, providing information (e.g. products, services), sales delivery (e.g. encouraging shoppers to join), discussing digital banking services and professionalism (e.g. friendliness, patience, knowledge).

We then bench-marked their performance against RBC.

What We Found – Among The Credit Unions

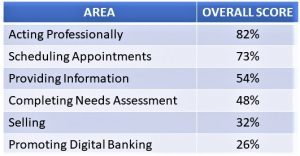

Overall, three levels of performance:

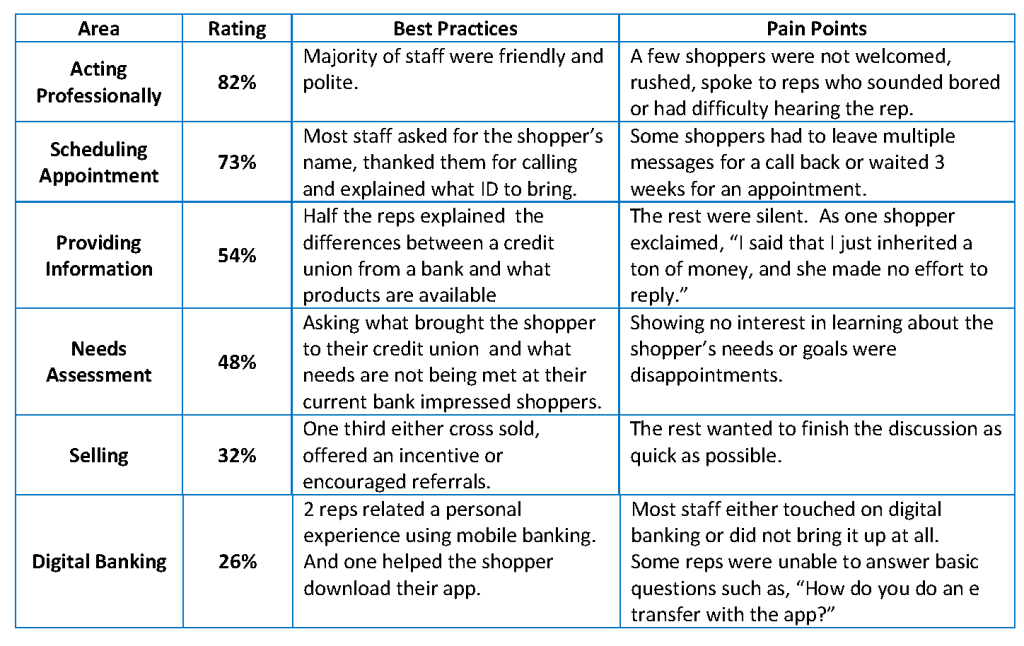

- Acting professionally and scheduling an appointment were done well.

- Providing information and completing a Needs Assessment were mediocre at best.

- Selling and discussing/promoting digital banking services were poorly done.

Best Practices and Pain Points

What We Found – Credit Unions Vs. RBC

While the credit unions edged out RBC in scheduling the shoppers’ appointments (73% vs 58%), they lagged in the 5 other areas, most notably selling (36% vs. 72%) and discussing digital banking (22% vs. 80%).

Why This Matters

Lacking sales drive is worrisome.

Shoppers expected to be asked to join as members. Many were not asked. Consequently, in a real situation, over a third of the potential members would hesitate to join a credit union due to this disconnect.

This lack of interest translates into $16 MM per year or more, in lost revenue:

- Let’s assume between their contact centre and branches, a credit union, receives 40 inquiries per month (or 480 per year) from potential customers.

- Using the shop results as a base line, no less than a third of these inquiries (or 158) would not be pursued further.

- Over a 25 year period, a member generates, on average, $100,000 in revenue or $4,000 per year. This works out to $16 MM potential revenue loss ($100,000 x 158 lost customers) per year.

Call To Action

Credit unions need to instill into their staff a mind set to sell. This means reassuring staff that they will not offend a prospective member by asking for their business. If anything, it will make the prospective member feel more valued.

(An interesting finding – some RBC shoppers were followed up by branch managers a day or two after their shop and encouraged to bring all their business over to RBC.)