Introduction:

Credit unions often differentiate themselves from banks as being non-for-profit institutions that offer lower fees, contribute generously to local communities and share profits with their “members” (i.e., customers).

These advantages certainly make for appealing messaging. But what about the in-branch experience that often determines how much business a member ends up giving their credit union?

No doubt, those branches that surpass customer expectations will generate greater loyalty and business.

So what are these best practices we can learn from? To answer this question we completed, over the past 3 years, a series of mystery shops (with our own budget), assessing 25 credit unions.

Five Shopper Scenarios

- Inquiring about joining the credit union

- Scheduling an appointment

- Signing up to be a new member

- Requesting assistance with their mobile banking app

- Inquiring about Small Business Banking (SBB) services.

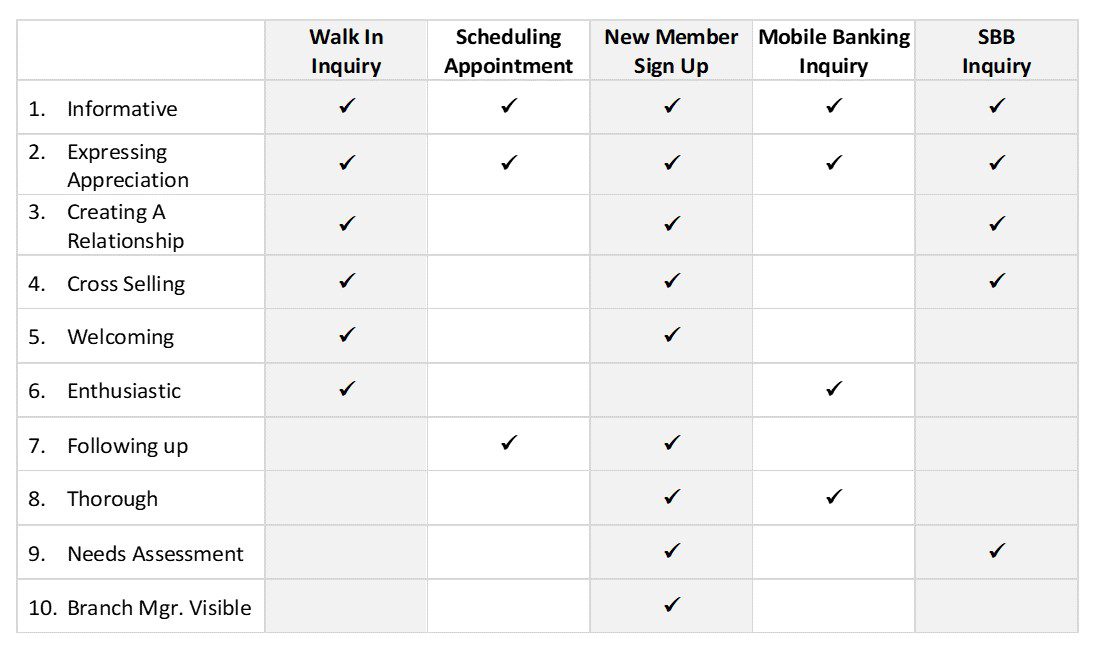

Frequent Best Practices

- Being informative

- Expressing appreciation (for the interest shown by the shopper)

- Creating a relationship

- Making an effort to probe for specific needs and sell appropriate services

Other Best Practices Relate to:

- Displaying a positive attitude (e.g. welcoming, enthusiastic)

- Acting professionally (e.g., conducting a needs assessment, following up)

- Branch manager taking an active role in interacting with members

Impact of the Branch Manager

We discovered a strong correlation between those branches that performed exceptionally well and the hands on involvement of the branch manager in these branches.

Simply put, the more active the branch manager was in interacting with customers, the more engaged and committed were the rest of the branch staff in helping customers.

Standing at the entrance greeting customers, personally thanking a new customer for joining, helping tellers when the branch is busy are examples of what branch managers did that impressed shoppers.

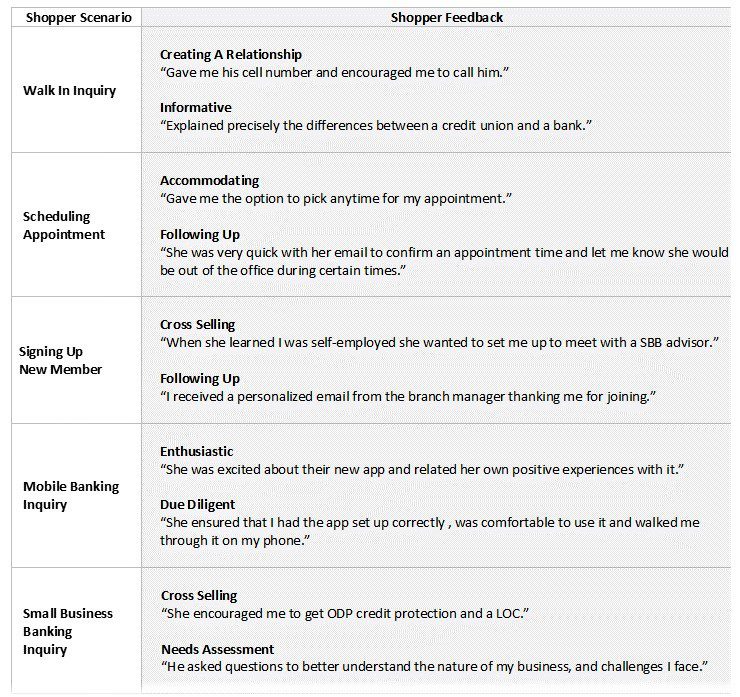

Shopper Feedback

- From the branch shops conducted, we discovered in total 67 best practices.

- Below are 10 examples.

Conclusion

Certainly providing lower service fees, local community support, profit sharing and more branch locations (through mergers) to choose from are important advantages that credit unions offer.

Nonetheless, what strikes an even greater chord is the individual actions by branch staff (led by branch managers) to make customers feel valued.