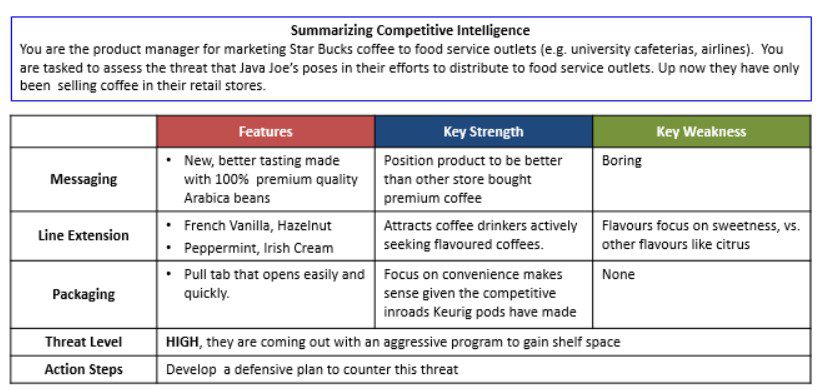

The challenge in competitive intelligence is dealing with lots and lots of fragmented data stemming from a myriad of sources. The best way to do this is by creating and filling a summary table. Sure this sounds like a simple, obvious solution. But the trick is setting up the table and determining what information should be entered. Goal of your Summary Table Ultimately the goal is to cover the key intelligence questions with enough detail, specificity and clarity that leads to meaningful insights about the competitor you’re researching. So how to go about it? 2 Tables Not 1. There are 2 tables to generate: The first plots your findings, where the… Read More

Continue Reading