Introduction

Given the volatility of the current economy, and the uncertain future actions of the Bank of Canada, more and more investors are seeking safer alternatives to invest their money.

Furthermore, while the annual pace of inflation is outpacing the rates being offered by GICs, the guaranteed nature of this investment is appealing for those investors burned by the downturn in the markets this year.

No doubt many investors are savvy enough to ask for higher rates than posted.

With this in mind, we recently conducted a mystery shop to see how much higher investment advisors financial institutions (FIs) were willing to offer customers than the posted rates.

5 major banks, 3 regional, 3 credit unions and Oaken Financial were shopped. Shoppers were long term customers of their respective FI. They each met in branch with their advisor.

Their scenario, “I’m expecting a $500,000 inheritance, and with the money will purchase a fixed term GIC. I don’t want to get burned with a riskier investment, even an indexed GIC. Can you offer me rates better than those listed on the website?”

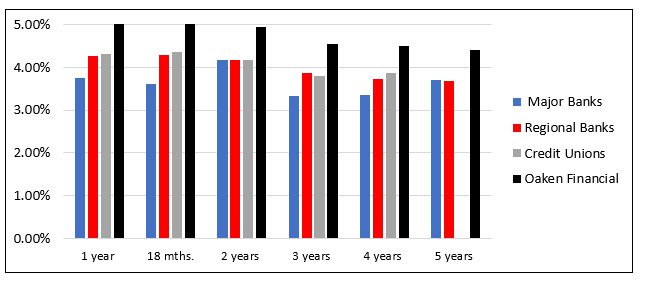

Findings – Posted GIC Rates

Oaken Financial offered the highest posted rates. (By posting the maximum rate they can offer in meeting their performance benchmarks, they are living their stated values of “transparency and placing the customer first”.)

For the most part, the major banks posted rates lagged both regional banks and credit unions. (While the size of each major banks allows them to post lower rates generally, the regional banks and credit unions appear to play a middle-of-the-road game with their rates to attract business at a reasonable additional cost).

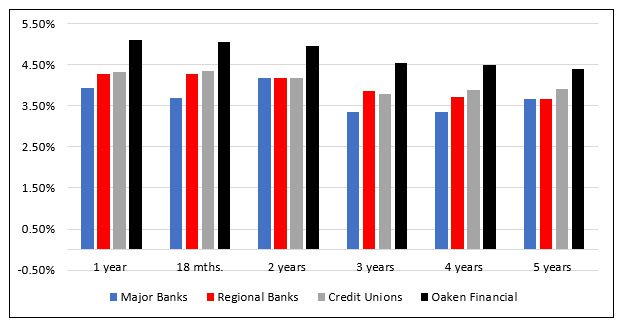

Negotiated Rates

Though Oaken Financial’s advisors would not negotiate higher rates, their posted rates were still greater than the other financial institutions’ negotiated rates. (A key in obtaining the business is their advisors making clients aware of Oaken Financial’s leading the marketplace in GIC rates).

Most major bank advisors agreed to higher increases in interest than either the regional banks or credit unions. (The major banks require considerable funding to match their lending portfolios, more so than the regional banks and credit unions,).

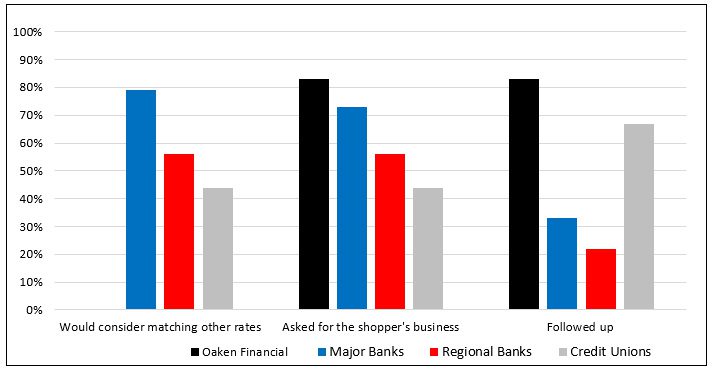

Sales Delivery

All Oaken Financial advisors asked for the shopper’s business and most followed up.

While most major bank advisors would consider matching competitor rates and did ask for the shopper’s business, two thirds failed to follow up.

Only half the regional bank advisors would consider matching competitor rates or asked for the shopper’s business.

And less than a quarter followed up.

Though fewer credit union advisors asked for the shopper’s business, two thirds did follow up. (The fact that two thirds of the advisors followed up is reflective of their culture i.e. offering greater personalized service than the banks).

Bottom Line

In a real situation, 83% of Oaken Financial shoppers, 80% of major bank shoppers, 67% of credit union shoppers and 61% of regional bank shoppers would purchase the $500k GIC based on their shop experience.

These bottom line, real situation statistics reflects the relationship piece of this GIC puzzle:

Investors in these economic times, are interested in mitigating their risk by investing with their primary institution, whom they know, and consider a safer place to invest a large sum of funds.

And the recent bank failures in the US no doubt occupy some space in their mindset.