Introduction

Financial institutions, whether banks, credit unions or brokerage firms often (and rightly so) create inspiring statements of what their advisors will do to help clients achieve their financial dreams.

RBC’s website, for example, reads, “Our advisors take the time to understand your life’s vision, customizing solutions based on your goals and aspirations.”

While Assante’s states, “Assante has an enviable roster of respected, knowledgeable and dedicated advisors who have the expertise to guide their clients through all the complexities their wealth may bring.”

These messages no doubt bring new customers to the door. But after that, it’s left to the advisor to succeed (or fail) in closing the sale. And their success is driven not only by expertise and experience, but more importantly by a motivation to win new clients.

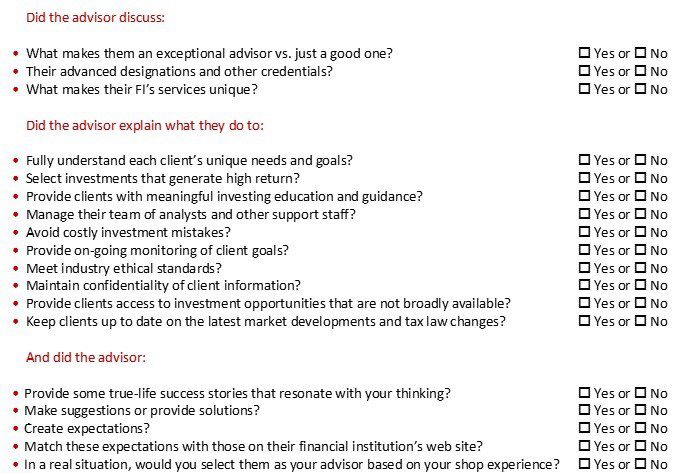

Mystery Shop Questions

Over the past 25 years of shopping financial advisors, I have observed both highly committed professionals and ones who make little effort to be engaged. This difference often boils down to how motivated the advisor is in winning the shopper over.

If you’re planning to mystery shop your financial advisors’ sales delivery to pinpoint gaps in, consider the following questions:

Why This Matters

Why This Matters

Motivation is a key determinant in successfully winning new business. Sophisticated sales literature, advanced investment tools and extensive staff support are meaningless without a sincere effort by the financial advisor to demonstrate that they will be instrumental in helping the prospective client grow their investments over the long term.

Given that financial advisors are a fairly high-level audience to assess, it’s critical to carefully select mystery shopping questions that each reflect this motivation to win over the prospective client.